tax loss harvesting wash sale

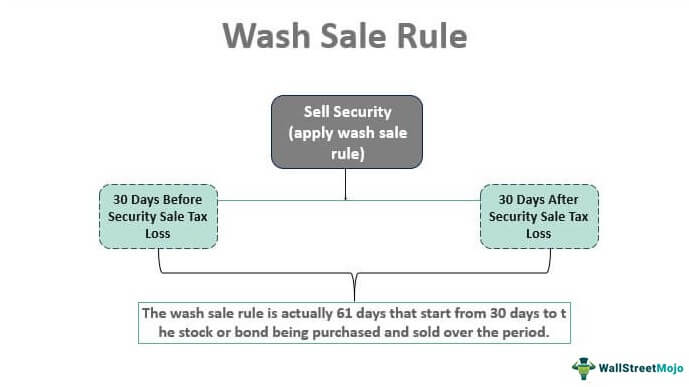

How the rule works Under this rule if you sell stock or securities for a loss and buy substantially identical stock or securities back within the 30-day period before or after the sale date the loss CANNOT be. The wash-sale rule is a regulation established by the Internal Revenue Service IRS in order to prevent taxpayers from being able to claim.

Wash Sale Rule Definition Example How It Works

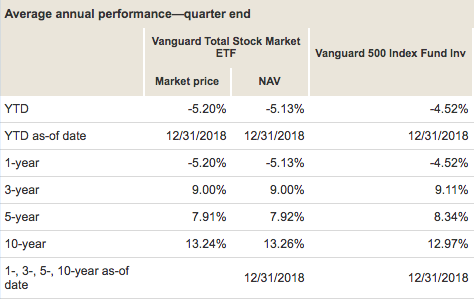

I dollar cost average into the vanguard total international stock index fund VTIAX on the 1st of every month.

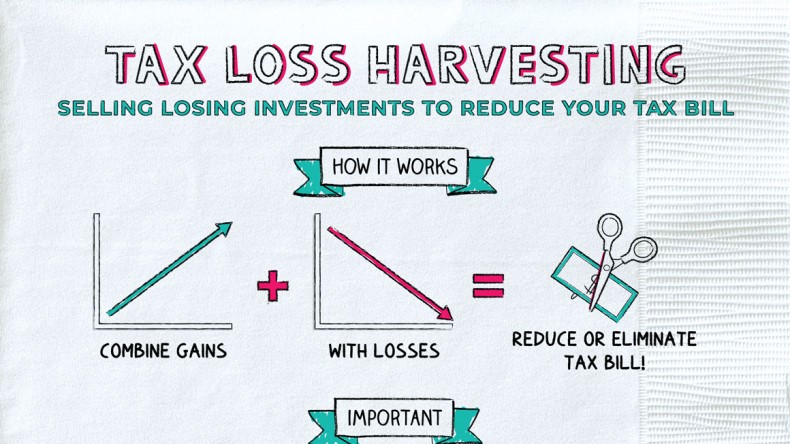

. Up to 3000 of losses each year can be taken as a deduction. The key to proper tax-loss harvesting comes down to facts and circumstances. I see that I have a 4000 loss currently in my account.

When I say winners or losers I refer exclusivity to whether there is. Mary can use the 7000 capital loss to. That is the investor cannot sell an asset at a loss and buy a substantially identical asset.

You can achieve the same goal with a less expensive alternative approach. Its important to note that you cannot get around the wash-sale rule by selling an. For example you currently own 1000 Yazoo shares that you.

I see so an example would be. Market action in the past couple of weeks has probably caused many investors to begin thinking about selling some securities to harvest losses for tax purposes. Tax Loss Harvesting and Wash Sale Rules.

A wash sale occurs when you sell or trade securities at a loss and within 30 days before or after the sale you--Buy substantially identical securities--Acquire substantially identical securities in a fully taxable trade or--Acquire a contract. If an investment is not expected to perform well or to decline in the future then that investment is usually sold to prevent or mitigate losses or to invest in better opportunities. TLDR This thing sucks.

If theres no open position for M stock across all accounts and no new trades were made for 30 calendar days after the last sell tax loss can be claimed for year 2021. Capital losses can offset capital gains or can give you a capital loss which you can report on your tax return. The asset sold is then replaced with a similar asset to maintain the portfolios asset allocation and expected risk and return levels IRS Wash Sale Rule.

The IRS will disallow the deduction of these losses. The wash sale rule is avoided because December 22 is more than 30 days after November 21. A vertical stack of three evenly spaced horizontal lines.

Wash Sale Rule Across Taxable Non-Taxable Accounts. The wash-sale rule prevents people from tax-loss harvesting by selling a stock at a loss and then immediately rebuying it. With tax-loss harvesting an investment that has an unrealized loss is sold allowing a credit against any realized gains that occurred in the portfolio.

Dec 29 2021 sold M stock at a loss. More specifically the wash-sale rule states that the tax loss will be disallowed if you buy the same security a contract or option to buy the security or a substantially identical security within 30 days before or after the date you sold the loss-generating investment its a 61-day window. The disallowed loss increases the tax basis of the substantially identical securities -- the Beta shares you acquire on 122121 -- to 20200 12200 cost.

Tax-Loss Harvesting And The Dry-Cleaned Wash Sale. Dec 28 2021 bought M stock. The wash sale rule prohibits an investor from taking a tax deduction if they sell an investment at a loss and repurchase the same investment or a.

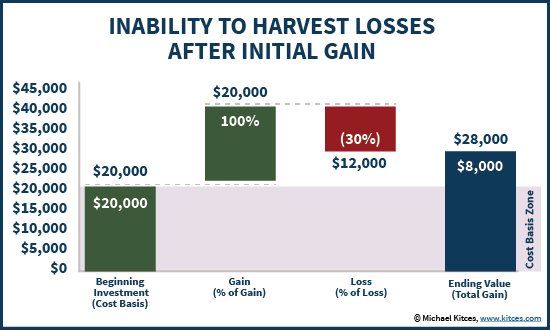

Therefore the tax basis of the Beta shares you acquire on December 19 2021 increases to 20200 12200 cost plus 8000 disallowed wash sale loss. However some investments are sold as part of a tax strategy to lower taxes especially at the end of the tax year. The wash-sale rule prevents people from tax-loss harvesting by selling a stock at a loss and then immediately rebuying it.

Tax Loss Harvest Wash Sale while dollar cost averaging 10-17-2018 0815 PM. Instead the disallowed loss increases the tax basis of the substantially identical securities. To tax-loss harvest Mary would sell that fund thereby recognizing a 7000 capital loss.

What you want to avoid in the 30-day window before and after tax loss harvesting is a wash sale. And potential penalties should an IRS audit classify. Buy a cheap call option on the stock you want to sell for a 2021 tax loss.

In order to make use of tax-loss harvesting the investor cannot violate the IRS wash sale rule. Can I TLH today 18th into another fund VFWAX which is not substantially similar without triggering. If youre planning to sell stocksmutual funds at a loss to offset realized capital gains during the year its important to be aware of the wash sale rule.

Then wait more than 30 days to sell the stock. And Mary would use the proceeds from the sale to purchase another fund to serve as a replacement in her portfolio. Sadly the wash sale rule disallows your anticipated 8000 capital loss deduction.

A wash sale occurs when a taxpayer harvests losses on a stock or security but purchases the same one or a substantially identical one within the 30 days before or after the sale. A wash sale is a purchase of identical or substantially identical replacement shares of an asset you sold at a loss during that 61-day 30 days before. The basic concept of the wash-sale rule is relatively straightforward its purpose is to limit someone from Tax Loss Harvesting TLH by just selling an investment for a tax loss and immediately buying it back again which could otherwise result in tax savings in the form of a deductible loss without the investor substantively changing hisher economic position at the.

Whenever you have significant losses in a taxable account you should consider tax loss harvesting selling those losses as a part of tax planning and then buying a placeholder security for 30 days.

Tax Loss Harvesting And Wash Sale Rules

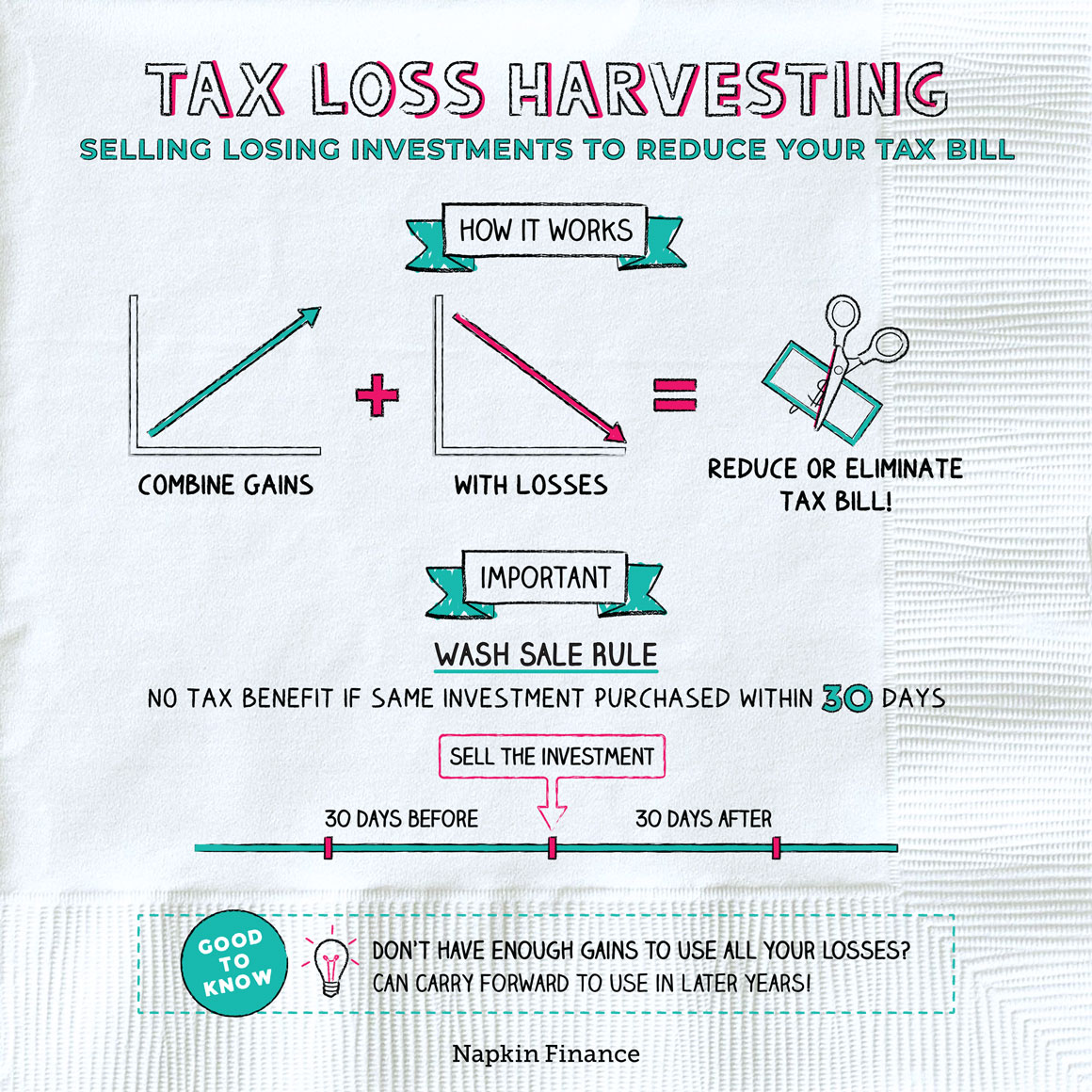

Tax Loss Harvesting Napkin Finance

Tax Loss Harvesting Using Losses To Enhance After Tax Returns Bny Mellon Wealth Management

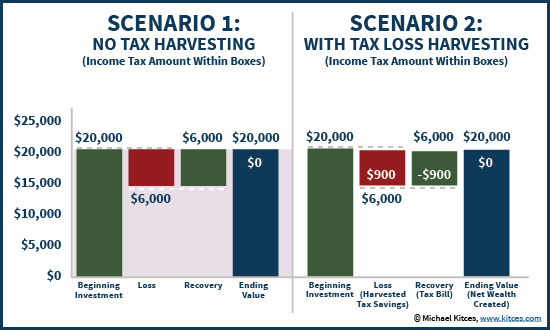

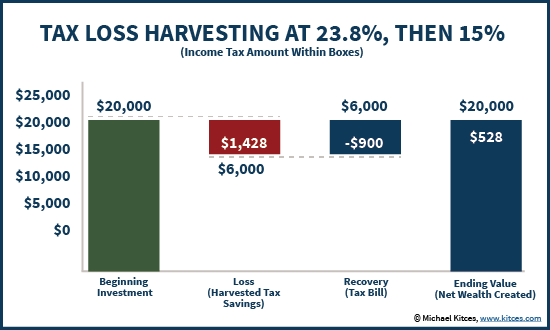

Calculating The True Benefits Of Tax Loss Harvesting Tlh

Year Round Tax Loss Harvesting Benefits Onebite

How To Use Tax Loss Harvesting To Lower Your Taxes Ally

Is Tax Loss Harvesting Worth It The Ultimate Guide Bull Oak Capital

Year End Financial To Do Considering The Tax Loss Harvesting Strategy Benjamin F Edwards

Tax Loss Harvesting Flowchart Bogleheads Org

Tax Loss Harvesting And Wash Sales Seeking Alpha

Tax Loss Harvesting And Tax Gain Harvesting Step By Step

Calculating The True Benefits Of Tax Loss Harvesting Tlh

Calculating The True Benefits Of Tax Loss Harvesting Tlh

.jpg)

The Ultimate Guide To Cryptocurrency Tax Loss Harvesting Cryptotrader Tax

What Is Tax Loss Harvesting Ticker Tape

Tax Loss Harvesting Definition Example How It Works

Tax Loss Harvesting Napkin Finance

.jpg)

The Ultimate Guide To Cryptocurrency Tax Loss Harvesting Cryptotrader Tax